Calculate my tax return 2022

Legal Secrets to Reducing Your Taxes. To find out what your final tax return summary will look like call 13 23 25 and let our tax accountants walk you through the tax refund process with ease.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

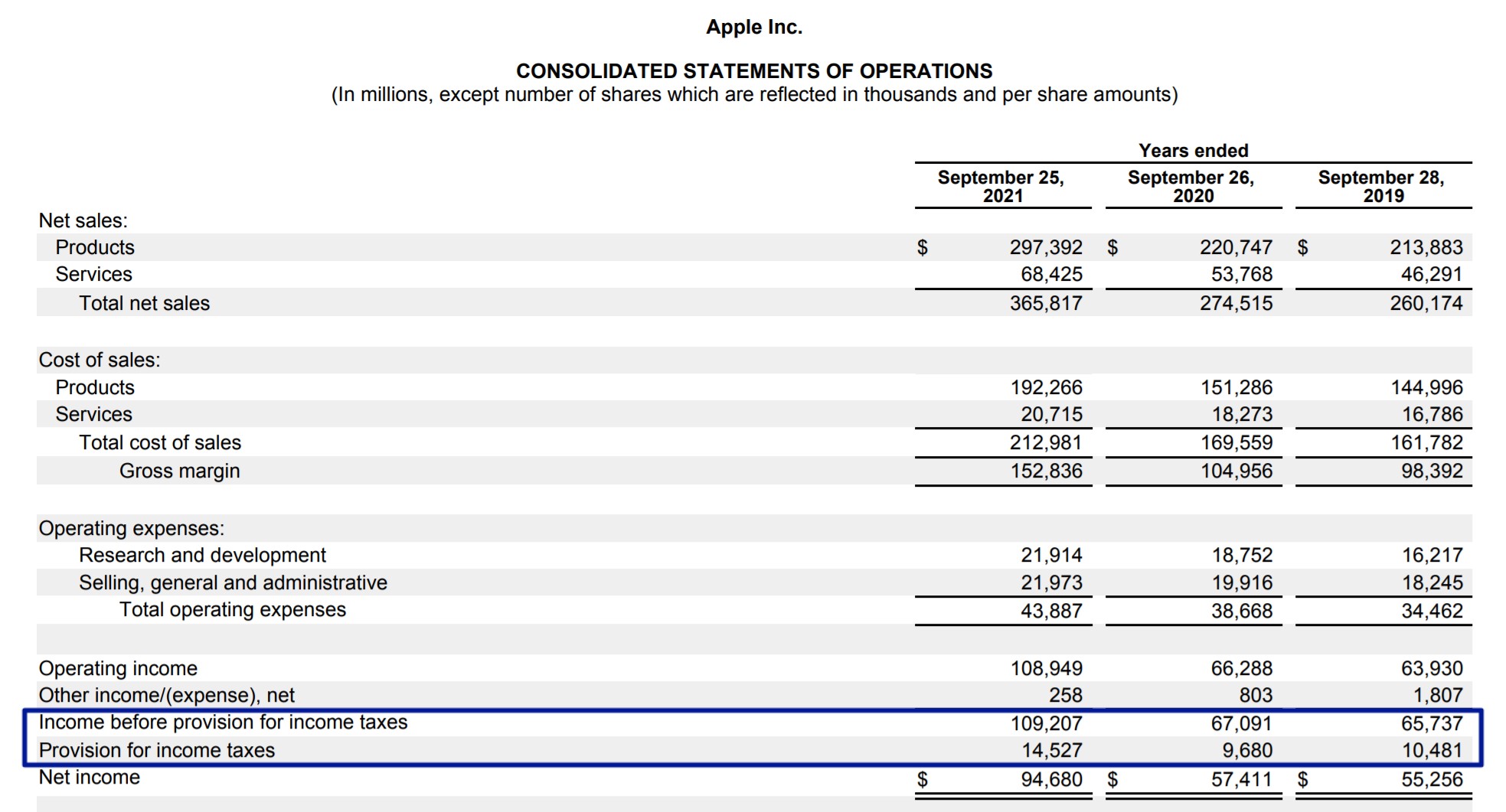

Business tax return versions are usually for a specific business type like partnerships corporations and S corporations.

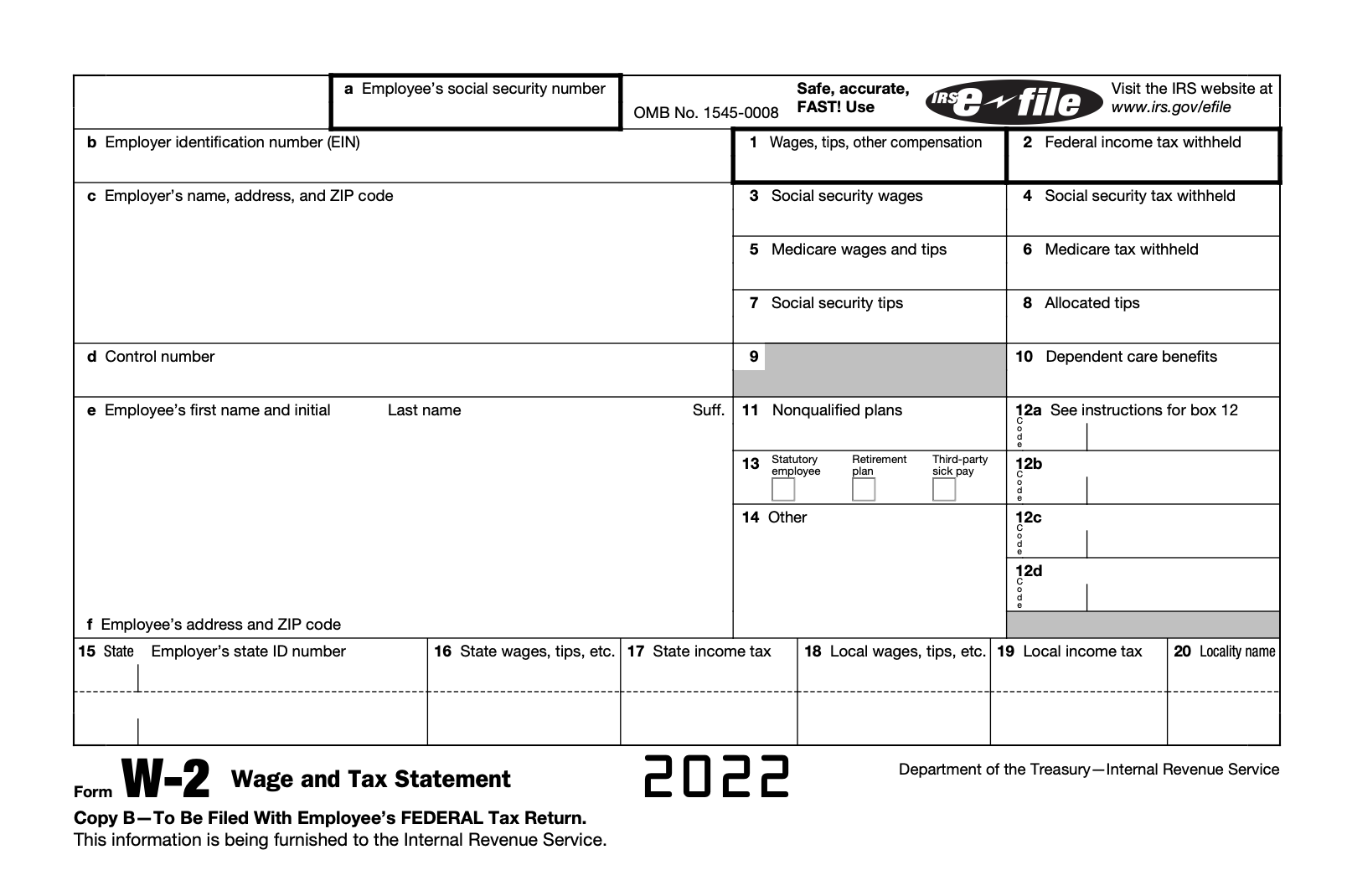

. Just enter your information and get an estimate of your tax refund. If you dont want to pay the 2022 quarterly taxes by mailing vouchers and checks we can tell you how to make quarterly payments electronically online at the. This includes the boxes that contain details like your name address and Social Security number.

You need to calculate the tax payable on such net taxable income. On a per-share basis the long-term gain would be 5 per share. Using the standard mileage rate or calculating your actual costs.

Are you looking to quickly estimate your 2022 tax return. 585 cents per mile. Calculating your W-2 income tax return is one of the tax basics that nearly everyone will need to do at some point.

The reason is that the methods applied to calculate depreciation expense for accounting and tax purposes do not always coincide. Calculating tax-equivalent yield allows investors to make an apples-to-apples comparison when weighing municipal bond returns against returns of other investments. The first step is actually just looking over your W-2 form to check that all of the information you see is correct.

The 202223 US Tax Calculator allow you to calculate and estimate your 202223 tax return compare salary packages review salary examples and review tax benefitstax allowances in 202223 based on the. Add up the total number of gallons of fuel you have purchased while youre at it jot down how much fuel tax you paid in each state more on this in later 2. Three days are left for filing an income tax return ITR for the fiscal FY22 the assessment year 2022-23.

Be sure your tax preparation software is the small business or self-employed version. Tax deducted will be refunded to you by the IT Department with applicable interest once you have filed your Income Tax Return and it has been processed by the IT Department. Your taxable income is taxed at the relevant tax slab rate and cess is added to give you your total tax payment.

See Form 1040-X Amended US. Calculate the tax payable for the financial year at the applicable income tax slab rate for FY 2022-23. If the IRA contributor does not have a workplace plan and their spouse does the 2021 limit starts at 198000 and no tax deduction is allowed once the contributors income reaches 208000.

Multiplying this value by 50 shares yields. Use the United States Tax Calculator below. Calculate income tax for the new regime.

For most years the deadline to submit your tax return and pay your tax bill is April 15. All rebates will be issued before the end of the year. Income Tax for Salaried.

2021 tax return due in 2022 2022 tax return due in 2023 Business mileage. For the 2021 tax filing season 912 of Canadians filed an electronic income tax and benefit return with 581 using EFILE 329 using NETFILE and 02 using the File My Return Service. If you decide to complete and sign your tax return most people finish in just minutes our qualified accountants check your return and look for suggestions about further deductions or.

However taxes for 2021 were required to be filed by April 18 2022 due to a legal holiday in Washington DC. However coming up with an accurate estimate is not always easy. You can file Form 1040-X Amended US.

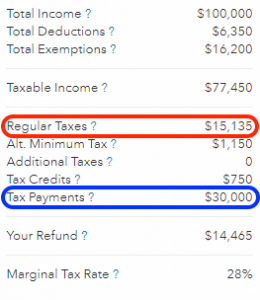

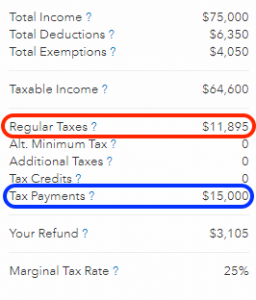

To calculate your effective tax rate you need two numbers. Heres how to open your already-filed return back up to go through the estimated taxes interview calculate estimated tax payments and print out 2022 Form 1040-ES vouchers if desired. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

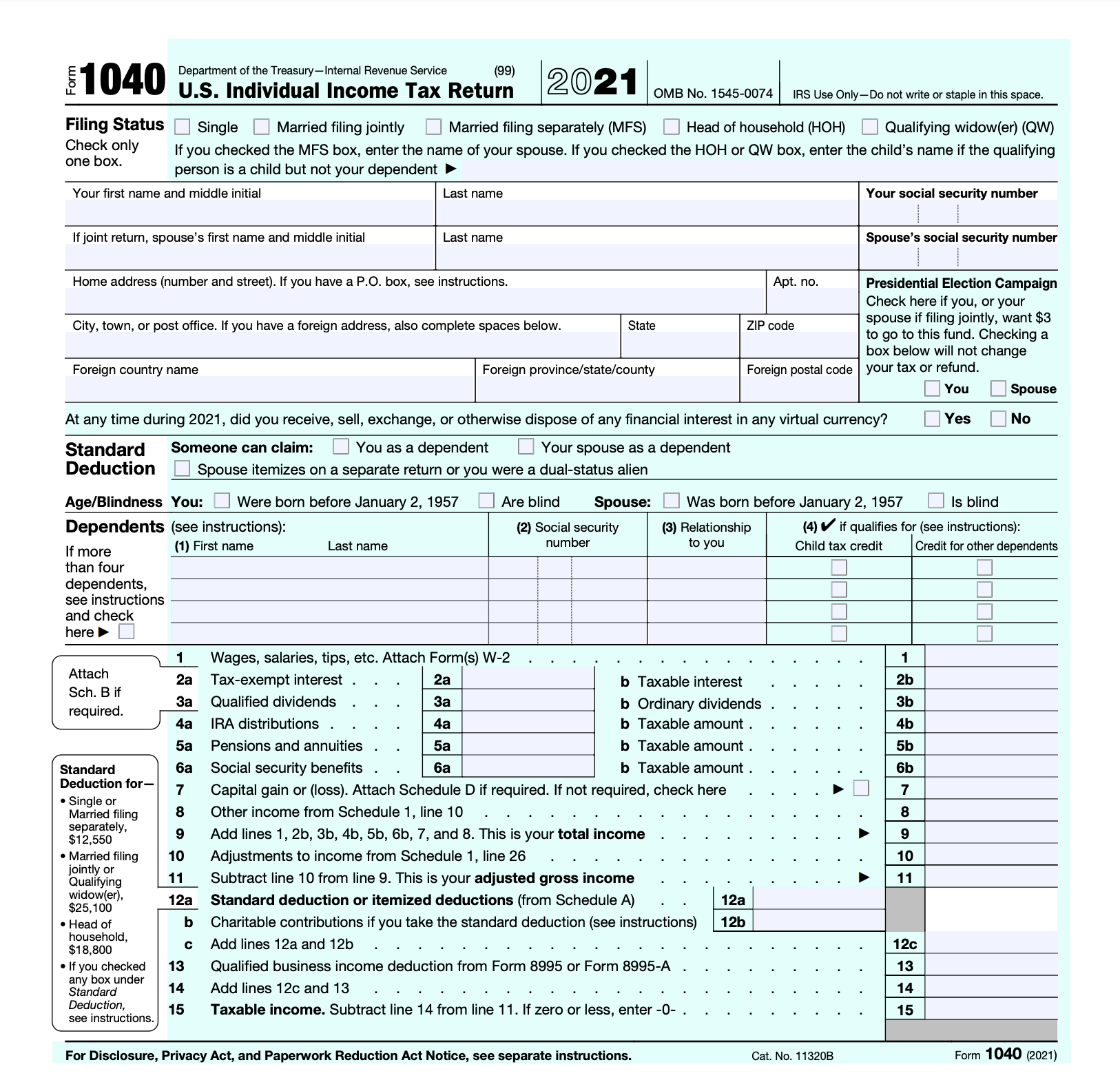

Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR. 18 cents per mile. No cash value and void if transferred or where prohibited.

Check back here for the latest rebate news After SC state lawmakers approved state tax rebates in June the South Carolina Department of Revenue will be issuing close to one billion dollars to eligible taxpayers who file a 2021 state Individual Income Tax return by the filing extension deadline on October 17 2022. The tax return filing deadline for the 2021 tax year is May 2 2022. Our office locator will help you locate your nearest office and you can book an appointment online.

Residents of Massachusetts and Maine had until April 19 2022. An excellent tool is the TurboTax tax refund calculator. So today we will show you two websites that offer a free online tax refund calculator for 2022 2023.

With the deadline of July 31 nearing a fixed deposit FD holder must ensure to file. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. There are two ways to calculate your mileage for your tax return.

Please be mindful that our tax calculations are only estimates. 16 cents per mile. Add up the total number of miles traveled across all states.

Tax-equivalent yield is a way to measure the return on a taxable bond or other investment to make it equal to the return associated with a tax-exempt bond or investment. In the new tax regime you forgo most exemptions and deductions for instance LTC HRA standard deduction deductions under Sections 80C 80D 80E 80G and so on. Know how to calculate Income Tax on your salary with examples save money under Tax Exemption Tax Rebate Tax Deduction Tax Saving.

For example accounting depreciation is commonly determined using the straight-line method but tax depreciation is generally calculated via accumulated depreciation methods eg double declining method. Lets further assume you sell 50 shares of this stock on Sept. 1 2022 for 25 a share.

First you need to calculate how many gallons of fuel you burnt per mile traveled fuel mileage. TurboTax Tax Refund Calculator. Medical and moving mileage.

United States Tax Calculator for 202223. The Tax Return Calculator is a free part of the Etax online tax return a paid tax agent serviceThe calculator provides an instant estimate of your tax refund or payable. Before you buy check to be sure it includes Schedule C and Schedule SE for self-employment taxes.

Calculate the taxes already paid during the financial year such as TDS advance tax self assessment tax. The total amount paid in taxes in 2021 and your taxable income in the same year. 56 cents per mile.

You still have the option to. Calculate the Tax Payable. Offer valid for returns filed 512020 - 5312020.

Individual Income Tax Return Frequently Asked Questions for more information.

2022 Tax Refund Schedule When Will I Get My Refund Smartasset

Effective Tax Rate Formula And Calculation Example

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Taxes Due Today Last Chance To File Your Tax Return Or Tax Extension On Time Cnet

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

2022 Income Tax Withholding Tables Changes Examples

Cash App Taxes 100 Free Tax Filing For Federal State

Understanding Passive Activity Limits And Passive Losses 2022 Tax Update Stessa

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Best Tax Software For 2022 Late Or Not Turbotax H R Block And More Can Help You File Cnet

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

2022 2023 Tax Brackets Rates For Each Income Level

When Are Taxes Due In 2022 Forbes Advisor

Usa Tax Form 1040 Being Completed Containing 1040 Tax Form 2014 And Document In 2022 Tax Forms Income Tax Return Country Names

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet